Wednesday 15th March saw the nation’s health top of the government agenda with the launch of the new Eatwell Guide and more surprising, the new budget announcement declaring a tax for sweetened beverages.

We are still in the dark about the how much tax will be added, but it is thought that it will be set at the PHE recommendation of 20%, despite the National Obesity Forum recommendation to set it at 50% if any impact on behaviour change is to occur.

Which soft drinks will be hit?

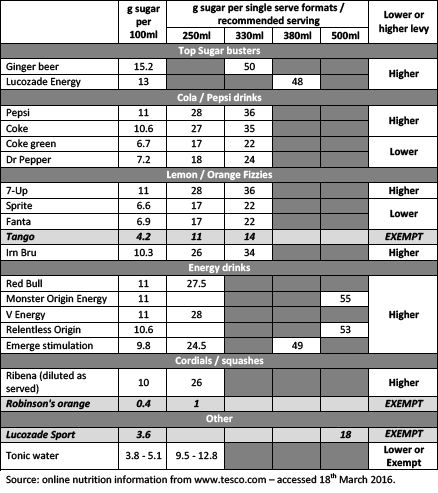

Two tax levels will be set. One for soft drinks providing more than 5g sugar per 100ml and a higher levy for those providing more than 8g sugar per 100ml. The table below indicates how the current soft drinks market will be taxed.

Nutrilicious feels that single serve formats should have been taken into consideration when setting the sugar benchmarks, similarly to front of pack traffic light labelling. As an example, sports drinks are only available as a single 500ml serve bottle providing a total of 18g sugars, yet because they contain less than 5g sugar per 100ml, they will be exempt. This could be argued by other soft drinks companies as unfair. Many that will be taxed for containing over 5g or 8g sugar per 100ml, offer much small single serve formats, limiting the total serve sugar intake to the same as sports drinks and sometimes less.

Exemptions: fruit juice, milk drinks and small producers. This does muddy the waters somewhat as the government in its new sugars recommendations classified fruit juice as a ‘free sugars’ source and why are small producers exempt if they do produce high sugar drinks? Not quite an even playing field and this will not encourage innovation for lower sugar products from companies who will be exempt. Also, what does ‘milk drinks’ refer to? Will sugar laden flavoured milk drinks be exempt?

When will it be enforced? The tax will come into force in April 2018, giving manufacturers adequate time to reformulate their drinks and / or change their offerings to consumers. Many could try to reduce their sugars from the higher to the lower levy benchmark.

Will this reduce consumer purchase of higher sugar soft drinks? Possibly not, but the government is banking on this levy to add over £500 million to the economy which will be used to:

- Double the primary school PE and sport premium.

- Give 25% of secondary schools increased opportunity to extend their school day to offer a wider range of activities for pupils, including more sport.

- Expand breakfast clubs in up to 1,600 schools.

So, Jamie has won the battle to place taxes on sweetened drinks and this will be welcomed by health organisations even though many of them wanted to see a significantly higher levy. We do feel that a more even playing field should have been set and all high sugar drinks, including fruit juice and drinks from small producers, should have the levy enforced. In addition, single serve formats should be considered when assessing sugar levels. If anything, this could go a long way to help prevent consumers’ from being misled by marketing claims that a soft drink ‘is full of / provides energy’. A clever abuse by some manufacturers regarding consumer’s misunderstanding of the word ‘energy’ relating to healthiness rather than empty unnecessary calories. We look forward to more specific details.

A selection of current soft drinks on the market, their sugar content per 100ml and their single serve format or recommended serving size and which tax level they will incur in April 2018.

Sugar Drinks details

For further information on the 2016 budget: www.gov.uk/government/publications/budget-2016-documents/budget-2016